EMAT Database (“Epsilon Multiple Analysis Tool”)

The reference source on European M&A Transaction Multiples for the Valuation of Private Companies

Private M&A Market Data You Can Trust

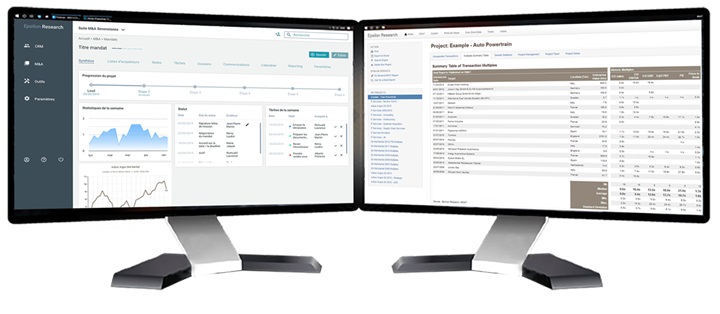

EMAT multiple analysis tool

The Reference Source for Private Company Acquisition Multiples

Unique online access to European private transaction analysis reports & acquisition multiples

- Online access to reports covering all major European small and mid-market M&A and LBO transactions

- Detailed analysis of each transaction : deal context and structure, target business and financials, transaction multiples (calculation, comparison and analysis)

- All information sources are systematically given

- A powerful search facility: date, size, deal type, country and industry sector + key words

- Possibility to compose your own comparable indices

- Optional access to monitor all transactions not retained for multiple analysis (see "CorpfinDeals")

- Transactions M&A - LBO maj. (including a control premium, giving the acquirer > 50% of the target’s shares)

- Equity Value : €1-500m

- Target in the EC

- Since 01/01/2004 (deal announced date)

- All industry sectors

- Transaction value not confidential

- Enough information (deal value and target financials) to be able to calculate at least one significant multiple

-

Establishing the “market value” of private investments

- BVCA / EVCA recommendations and increasing investor pressure for regular portfolio valuations

- For “fair value” valuations, the use of comparable transaction multiples is key

-

Valuing portfolio investments / exits

- Put together a sample of comparable multiples in an instant

- Use Epsilon’s sector classification, based on the International Classification Benchmark

-

View all available deal information to check multiples and ensure they are relevant

- Standard methodology (consistent financial restatements, multiple calculation)

- Transparent use of information, relevant data

-

Use Epsilon’s research service to:

- Carry out ad-hoc research on a business sector or specific deal

- Receive copies of source info used in a report by e-mail

- Contact our financial analysts regarding specific sectors or reports